Are We Dealing With a Two-Speed Economy in Cambodia? – Mekong Strategic Capital Economic Outlook 2026

A recent economic update shared by Mekong Strategic Capital (MSC) outlines reasons for both optimism and caution in Cambodia. The firm posited that Cambodia’s economy is becoming increasingly two-speed, with many households and domestic businesses facing increasing pressure from downturns in sectors like tourism and real estate, even as other parts of the formal economy show strength.

MSC’s short-term growth forecast is slightly more positive now than it was from their last report in August 2025, predicting a GDP growth of around 4 per cent in both 2025 and 2026.

Signs of Economic Strength: High Exports and Consumption

Rising Export Markets With Minimal Impact From U.S. Tariffs

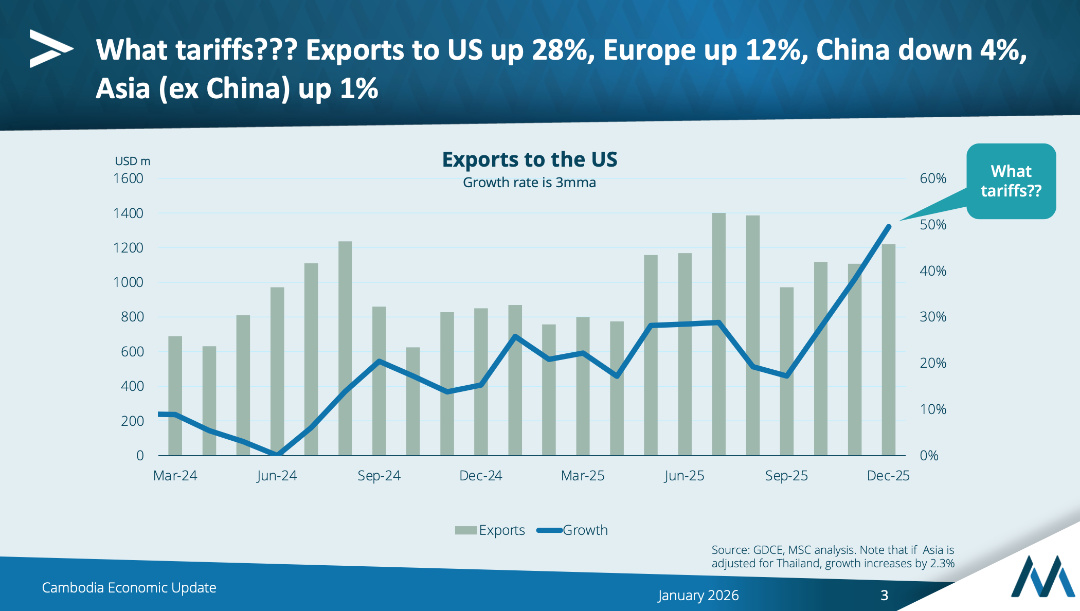

Starting off with a review of the positive outcomes of 2025, MSC highlighted a rise in exports, even in spite of U.S. tariff uncertainty, as a major sign of economic resilience.

The report pointed to the strength of gold exports as an example, having risen 15 per cent year-on-year in 2025, and 33 per cent since 2023. The Ministry of Commerce’s annual results report for 2025 also revealed that Cambodia’s overall exports rose to USD 31.28 billion, marking a 17 per cent increase from 2024.

Exports to the United States were still up 28 per cent, revealing the minimal impact tariffs – which eventually settled at 19 per cent for Cambodia – seemed to have on demand. Exports to Europe were also up 12 per cent, while exports to China slightly dipped by 4 per cent.

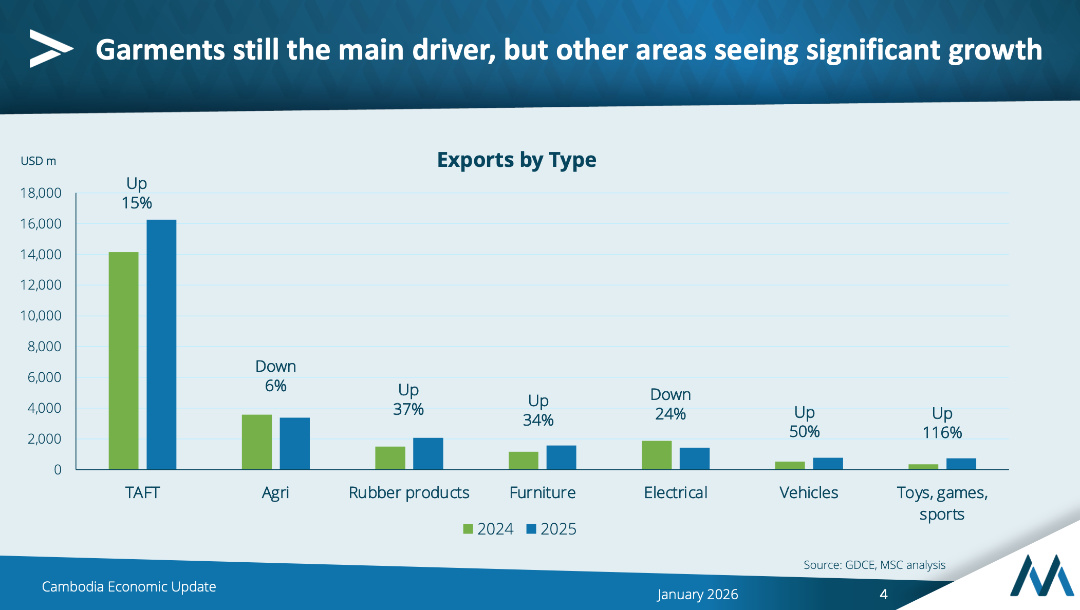

While garments continued to be the main driver of exports in 2025 (up 15 per cent), other areas like rubber products (up 37 per cent), furniture (up 34 per cent), vehicles (up 50 per cent) and toys, games and sports (up 116 per cent) saw significant growth.

Increased Imports of Capital Goods

The rise in imports of capital goods – machinery and electrical equipment – was also underlined as a positive sign of ongoing investment, particularly in manufacturing.

Imports of capital goods were up 93 per cent compared to 2023, based on data published by the General Department of Customs and Excise (GDCE).

Consumption and Growth

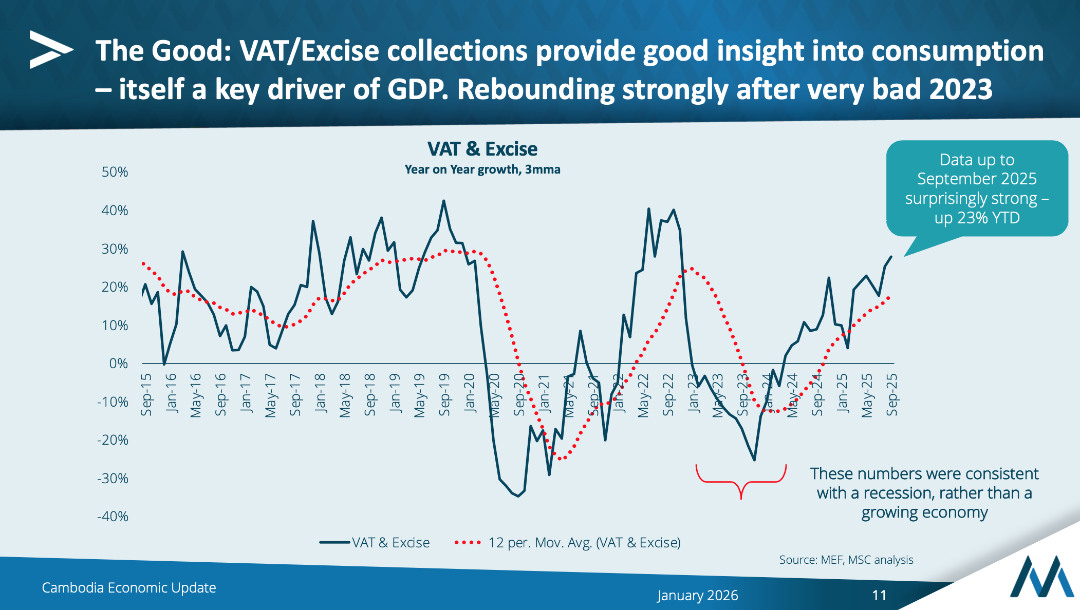

The MSC report uses data on VAT and excise collections to provide insight on consumption, which is rebounding strongly after a particularly poor showing in 2023.

The latest data from the Ministry of Economy and Finance (MEF) up to September 2025 revealed a strong 23 per cent year-to-date rise. In contrast, between 2023 to early 2024, MSC said the VAT and excise collection numbers were consistent with a recession, rather than a growing economy.

Ongoing strength in vehicle imports also further supports the theory that consumption is back on the rise. In 2025, vehicle imports rose 51 per cent compared to 2024, and 93 per cent compared to 2023.

Signs of Weakness: High Loan Arrears and Continued Tourism Struggles

Shifting to signs of weakness in the economy, MSC pointed to two main areas: high loan arrears and a struggling tourism sector.

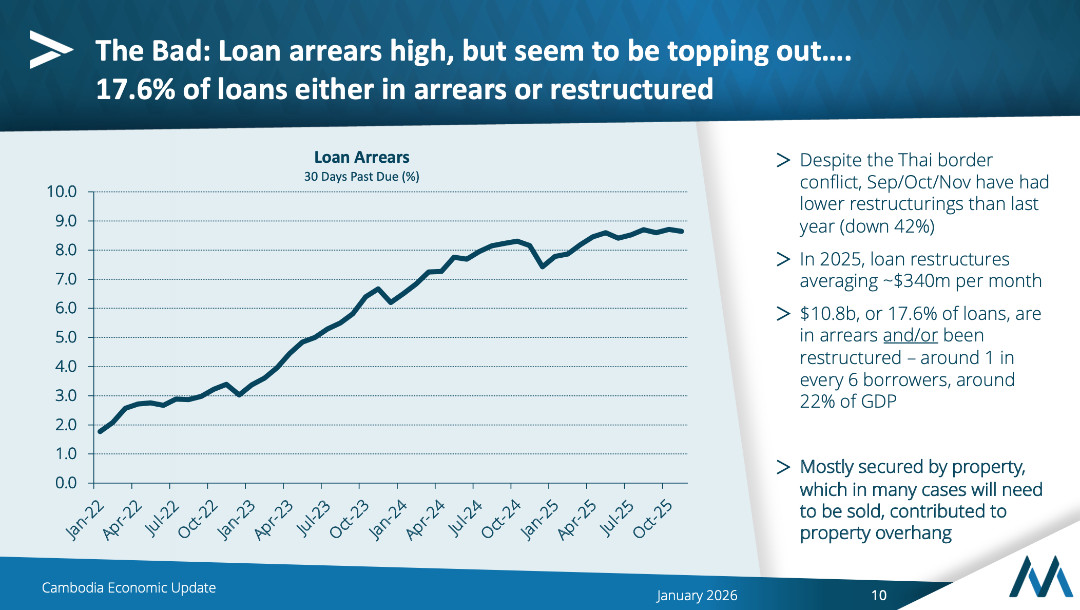

Regarding loans, the report noted that while arrears are high, they appear to be cresting, with lower restructurings recorded in the last few months of 2025, compared to 2024. Overall, around USD 10.8 billion, or 17.6 per cent of loans in Cambodia, are in arrears and/or has been restructured. This number is significant, averaging at around one in every six borrowers, and accounting for about 22 per cent of the GDP. Most loans are secured by property that needs to be sold, which will only contribute more to property overhang.

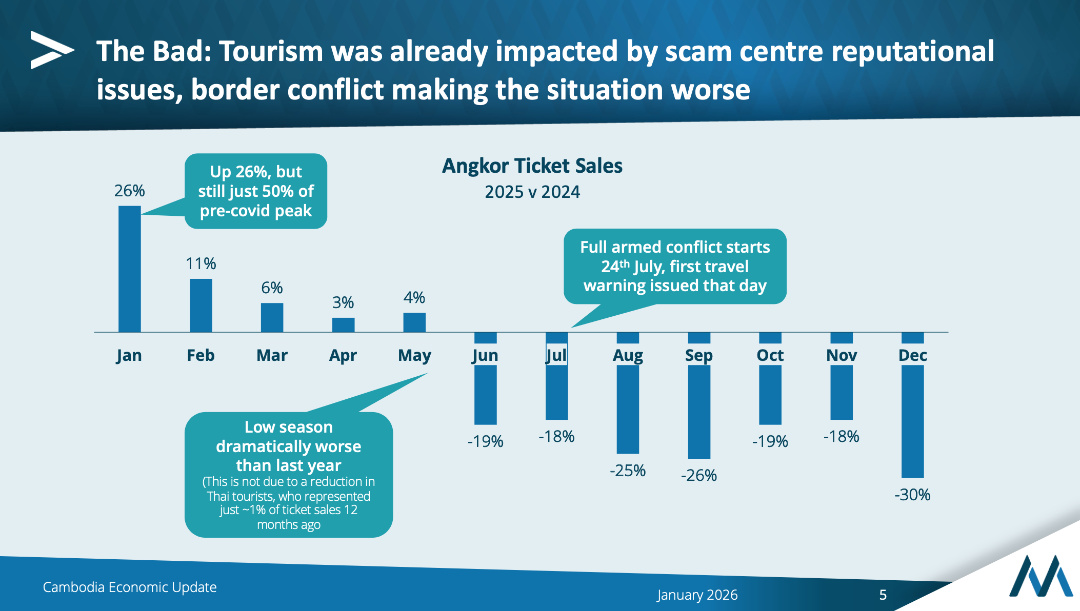

Tourism, one of Cambodia’s main economic pillars, has been on a slow journey of recovery since the pandemic. The MSC report stressed that the tourism sector was largely impacted by ongoing scam centre reputational issues in 2025, with the Thai border conflict only making the situation worse.

Using Angkor Wat ticket sales to illustrate the difficult situation, the MSC report showed that ticket sales peaked in January 2025, with a 26 per cent recorded increase compared to the same period in 2024. However, even this peak was just 50 per cent of the highs recorded pre-COVID.

More troubling was that 2025’s low season recorded “dramatically worse” numbers than in 2024, with sales down 19 per cent in June. MSC clarified this particular drop could not be attributed to a reduction in Thai tourists either, as they represented only around 1 per cent of ticket sales in the same month in 2024.

After the first full armed conflict with Thailand started on July 24, and numerous international embassies began issuing travel warnings, monthly ticket sales were consistently between 18 to 30 per cent lower than in 2024, with the biggest comparative drop recorded in December.

The MSC report highlighted how the fall in tourism was more pronounced from East Asian countries, as they are more likely to be sensitive to the reputational impacts of scam centres. Tourists from Japan and Korea were at just 23 per cent of their pre-COVID levels in 2025, while tourists from ‘Western’ countries reached 88 per cent of their pre-COVID levels.

The stark difference in tourism numbers between Cambodia and Vietnam further illustrates the major cost Cambodia’s reputational issues have had, while regional peers continue to flourish. For that reason, MSC stated it believes the “single most important thing that the [Cambodian government] can do to support the economy, and protect the future of Cambodia, is to shut down the scam centres”.

Mixed Outlook Ahead

Looking at the big picture, the MSC report concluded that Cambodia’s economic outlook is a mixed bag, with positive growth in exports and consumption balanced by declines in tourism and the real estate sector.

Scam centres and the Thai border conflict will most likely have a large negative impact on the short-term, however, MSC are still slightly more positive in their growth outlook, revising their forecast up to ~4 per cent growth in 2025 and 2026, from their previous prediction of ~3 per cent. Moreover, if Cambodia’s scam centre crackdowns prove to be effective, MSC sees the risks balancing further to the upside for 2026.