In B2B Cambodia's 'Legal Update' we delve into the latest legal changes and developments in Cambodia's laws and regulations with key experts in the field.

We sat down with Babulal Parihar, Director of Lochan & Co (Cambodia), to discuss annual compliance obligations in Cambodia for tax, accounting and labour as we prepare to close off 2025 and welcome 2026.

2026 Annual Tax Compliance Obligations

B2B Cambodia: What are the main annual tax compliance obligations and their deadlines that businesses should be aware of?

Babulal Parihar: "The annual tax declaration deadline is three months after the completion of the financial year. So basically, companies registered and operating in Cambodia are required to submit their annual tax return (2025 Tax on Income return) by 31 March 2026.

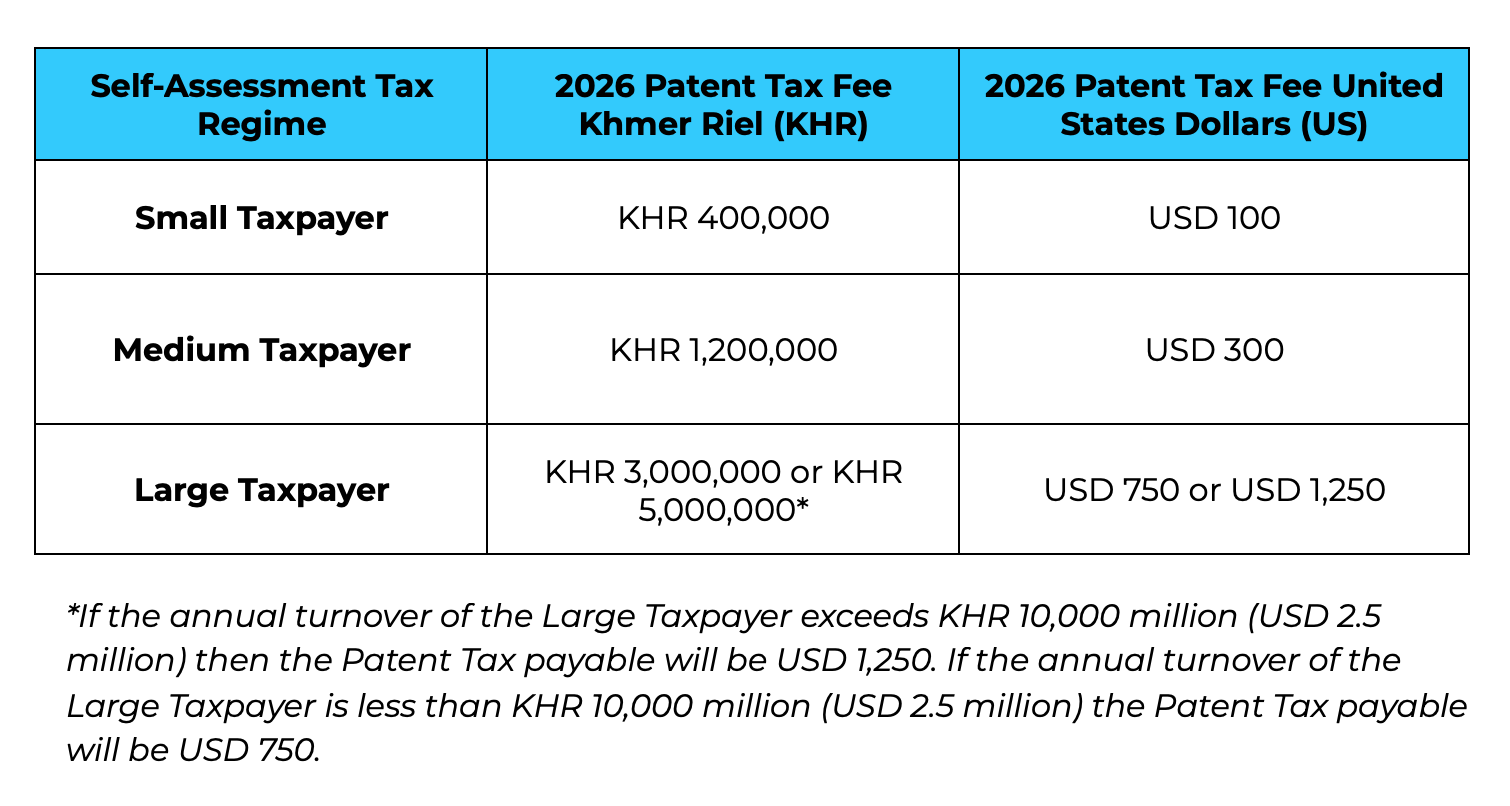

“Another important tax deadline is the renewal of the patent tax licences. Different enterprises, based on their sizes, are classified by the General Department of Taxation (GDT) as small taxpayers, medium taxpayers and large taxpayers, each with a different patent tax amount that they are supposed to pay. The deadline to renew the patent tax certificate is also 31 March 2026. These are two important things that comes to mind when we talk about the completion of the financial year and the important compliances we should be taking care of related to tax.”

B2B Cambodia: Are there any new annual tax compliance obligations that businesses should be aware of this year?

Babulal Parihar: “A new aspect of tax compliance that is important this year is related to transfer pricing, which was introduced in 2024 (Prakas 574 on the Rules and Procedures for Income and Expense Allocation among Related Parties, Dated 19 September 2024) but became applicable from 1 January 2025. This is technically the first year of implementation of this transfer pricing compliance, wherein companies that have related party transactions, apart from declaring those transaction in their annual tax declaration annexures, also have to prepare a transfer pricing local file that defines what are the different related party transactions they had during the financial year, as well as the different benchmarks they selected to determine the arm's length pricing. There are certain exemptions, but this is a new Prakas that needs to be taken into account by companies working in Cambodia.”

B2B Cambodia: What are the general penalties businesses can expect for not fulfilling their annual tax compliance obligations?

Babulal Parihar: “If an enterprise fails to submit their annual tax declaration, this is considered an obstruction of tax liability. Previously, this tax liability was USD 500, but now it has been increased to USD 1,250, which in local currency is basically KHR 5 million. Practically, the scenario may be different—unless and until the tax department sends a notice about non-compliance of the annual tax declaration, then only a penalty may be applicable, until then a penalty may not be applicable. But if you ask me about the law, it states that non-compliance will face a penalty of obstruction of tax liability, which is KHR 5 million.”

B2B Cambodia: Businesses should also be applying for their tax compliance certificates, with three levels of compliance recognised—bronze, silver and gold. What are the benefits of receiving gold compliance status?

Babulal Parihar: "The tax department of Cambodia has introduced different classifications of certificates based on a different weightage of points. These points are defined by the tax department based on the level of compliance. The total criteria is out of 20, so enterprises that receive 16 to 20 points can apply for gold status certificate, between 11 to 15 they can apply for the silver compliance certificate, and those with 1 to 10 can go for the bronze compliance certificate.

“Most organisations go for the gold status certificate. Once they have this gold status certificate, they will not fall under routine tax audits, that's the most important benefit. Second, enterprises going for a VAT refund will not need to go through a VAT audit again. There is a certain amount that has been specified for gold status certificate holders, for example, up to the KHR 500 million—if the VAT refund is applicable, then they don't have to go through the VAT audit. These are two main benefits, but if you ask me, more than that is gaining credibility in the eyes of the tax department, credibility in the eyes of clients and investors, which matters a lot.”

Watch Part 2 of our interview with Babulal Parihar on Annual ACAR Compliances

B2B Cambodia: What are the key annual compliance requirements for the Accounting and Auditing Regulator (ACAR) that businesses should be aware of?

Babulal Parihar: "The regulations for audits came in 2020, and then unaudited financial statement submission regulations came in 2021, so this is still fairly new. First, regarding the submission of audit reports—enterprises working in Cambodia, if they fulfil certain criteria that have been defined by ACAR then they have to get their books of accounts audited by an external auditor approved and licensed by ACAR.

"The criteria is broadly simple. If the company has an annual turnover of more than USD 1 million, if they have total assets of more than USD 750,000, or if they have more than 100 employees. So out of three, if any two criteria are met then those companies are compulsorily required to get their books of accounts audited. Apart from that, companies having QIP status are also required to get their books of accounts audited as well as the organisations also or NGOs having expenditures more than half a million dollars and employees more than 20 they also need to get their books of accounts audited. So that's the, that's the part and those enterprises or organisations who are not falling into any of this criteria of audit then they all are required to submit the unaudited financial statement. Now coming to the deadline then for unaudited financial statement submission to occur the deadline for submission the deadline is 20th April 2026 but when they should finalise the financial statement that is by 31st of March. So in case of audit submission of audited financing statement the deadline is 20th of July 2026. Okay, but by when they should finalise their by when they should have the audited financial statement that is 30th of June 2026. So basically six months after completion of.