B2B Asia News sat down with Milan Thomas, Country Economist for Cambodia at the Asian Development Bank (ADB), to discuss the findings from a recent ADB report on the impact of U.S. tariffs, as well as to gain an understanding of the Bank's economic outlook for Cambodia in the short and long-term.

B2B Asia News: Can you share some of the main insights from the ADB's report covering the impact of U.S. tariffs? What was the methodology used to write this report?

Milan Thomas: “The best way to get a real read on what's happening in response to the tariff is to frequently survey and interview households, businesses, get customs data, keep frequently getting the views of organisations like TAFTAC that are dealing with the tariff issue every day—that's the best way to get a real read. But, of course, the modelling has value as well, otherwise we wouldn't have done it.

The modelling takes historical data on Cambodia's trade performance and uses a set of mathematical rules on how households and businesses are expected to interact with each other to provide some new insights on the U.S. tariff. And this was done using a model that is pioneered by Victoria University's Centre for Policy Studies–that's in Australia.

"There's a wide range of findings. I think one of the great things about the model is that it provides very sector specific findings, and also provides a time profile on the impacts. So, rather than just saying this is the expected impact on GDP, it shows you year by year how the situation might evolve in response to a tariff.

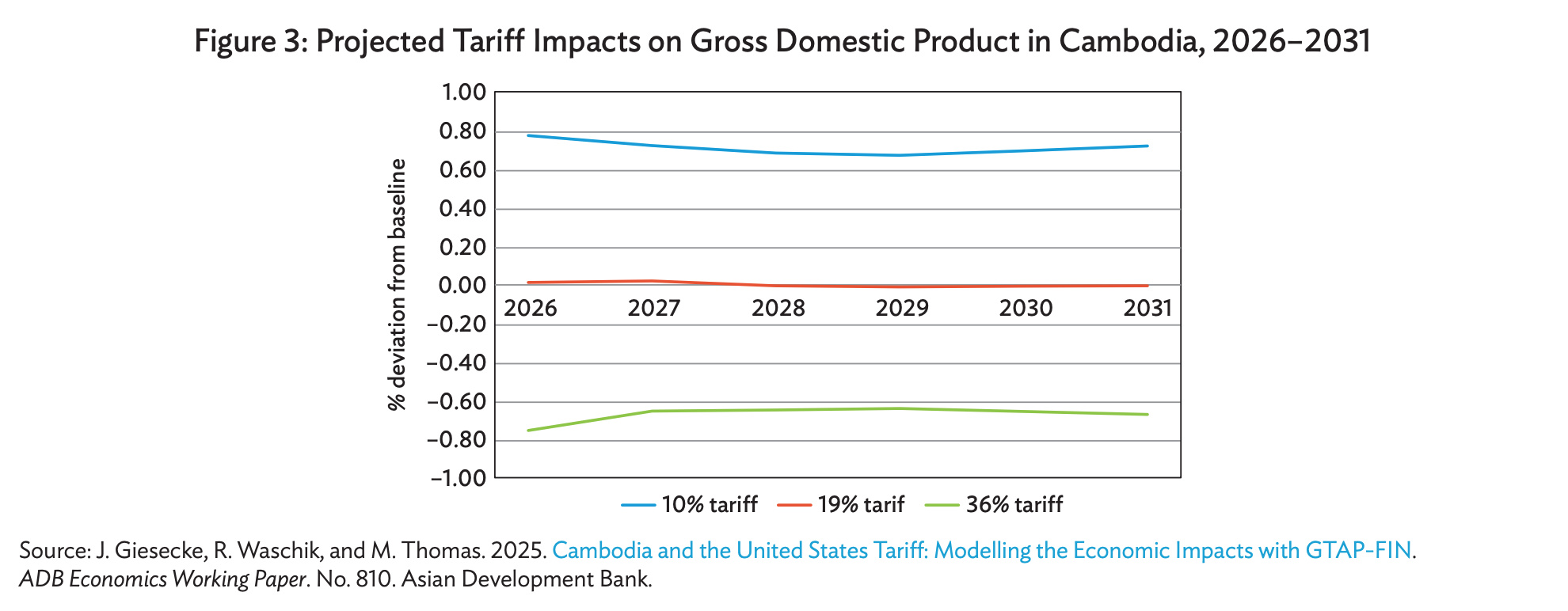

The main impact of the tariff really depends on how Cambodia's tariff is relative to its main competitors for exports to the United States. We've done this study over time and we have results from July, August and November. If you look at July, Cambodia's tariff was 36 per cent, which was about 10 percentage points higher than its average competitor. In that situation, the impact on GDP looks very poor. In fact, it would be quite devastating.

"At 36 per cent, we're looking at a 1 per cent loss of GDP, 100,000 industrial jobs disappearing, a 7 per cent increase in poverty, because export-oriented firms tend to hire workers that live near the poverty line.

Then we moved to August, when there was a downward adjustment, and they moved it from 36 per cent to 19 per cent. In that situation, Cambodia's tariff was a little more favourable than its average competitor, and we saw a zero impact of the tariff.

"Now, we reevaluated again in November. There's been no change in Cambodia's tariff, but the U.S. made some adjustments on some of Cambodia's competitors. For example, the People's Republic of China received a cut on their tariff, and that affects Cambodia's relative tariff. In that scenario, there's actually a small negative impact of the tariff on Cambodia.

"This is all just to say it's a very volatile situation, and, I think, more valuable than getting wrapped up in these small changes and how they affect the economy, it's more valuable to think about doing things like building trade competitiveness and trade facilitation through rules of origin compliance and also quality assurance certification.”

B2B Asia News: In the midst of this tariff crisis, Cambodia faced another major crisis through the border conflict with Thailand. What is the ADB's read on the situation and how it will impact the country's economy?

Milan Thomas: “This is a very difficult and developing situation and, of course, the impacts are already here for hundreds of thousands of families that have been affected either through displacement, or through return migration. There's been a loss of livelihoods and security that is having very real microeconomic impacts right now.

I think where there is less clarity is on the macroeconomic impact, and I mean in terms of GDP growth over the next year or two. It's different from the microeconomic impact in that while there are some clear negative effects—loss of income, loss of tourism receipts—there are also potentially some positive effects. For example, through import substitution, more domestic production, an increase in labour force. These are things that, under certain conditions, could be positive for the economy.

"Now, on net, it's most likely that the negative is going to outweigh the positive, because this is a very difficult situation. That's, indeed, what you see if you start looking at the economic indicators that are available to us right now.

According to surveys, two thirds of return migrants are having difficulty finding jobs. There's been a 20 per cent reduction in tourist arrivals in recent months. Bilateral trade is also depressed. These are things that are pointing in a clear negative direction.

"Things will become clearer as the situation hopefully settles down, but also as more data is collected. The Cambodia Development Resource Institute (CDRI) is currently fielding a detailed survey of migrants, and that's to build on surveys done previously by organisations like the National Bank of Cambodia (NBC), the International Labour Organisation (ILO) and International Organisation for Migration (IOM). This is all valuable information for understanding the situation and also planning a response.

“From what we're seeing on the modelling side, we're just starting to explore how these pieces fit together, but it looks like, aside from the very obvious direct impact on households that have lost lost their sources of income, an important indirect channel will be through the tourism sector, and that makes the government's ongoing efforts through things like the temporary waiver on visas for people visiting from the People's Republic of China, very important to promote the tourism sector.”

Watch Part 2 of our interview with Milan Thomas:

B2B Asia News: What can Cambodia do to deal with these negative economic impacts?

Milan Thomas: "The challenge, as always in these kinds of situations, is that resources are limited. And when resources are limited, I believe it's most important to focus on those who are most vulnerable, those who are least equipped to deal with the shock themselves. In the case of this particular evolving crisis, that would be rural workers, older workers who are finding it hard to get a new job and also, at the same time, are trying to support many dependents, especially school-aged children.

"If you look at the IDPoor programme, just in the last few months, since the conflict escalated, the IDPoor programme's coverage has increased by 5 per cent. It's enrolled households that include more than 200,000 individuals. That's a great sign of responsiveness. The efforts of the Ministry of Labour and Vocational Training have been pivotal in finding jobs for 300,000 workers. There's also upcoming new programmes like the graduation based social protection programme that's being rolled out in two areas of the country.

We're living in a world of policy shocks, climate shocks, technology shocks, and in this kind of world, no job is safe. All jobs are vulnerable. It doesn't matter if you're a seasonal worker in Thailand, if you're a factory worker in Kandal, or if you're an office worker in Vattanac Tower. All jobs are vulnerable. That's why it's so important that social protection programmes are very flexible in their coverage, but at the same time, inflexible in their commitment.

B2B Asia News: Given all these geopolitical developments, the ADB issued a downward revision of its growth forecasts for Cambodia in 2025 and 2026. Meanwhile, Cambodia is still expected to graduate from LDC status in 2029, and further down the line, become a high-income country by 2050. Would you say that Cambodia is still on track to meet these long-term growth targets? What does the country need to do to achieve these milestones?

Milan Thomas: "Starting with the short-term downgrade for 2025 and 2026 projections. This is a slight downgrade that's common across all economic observers, not just ADB. Of course, it reflects the dual shocks that we've been talking about so far, i.e. the tariff and the border crisis.

"Turning more to your question about the long-term, the simple mathematical answer is no, but I want to qualify that heavily. Cambodia, since the COVID-19 crisis ended, has been growing at roughly 5 per cent per year. If Cambodia were to continue to grow at 5 per cent per year, it would reach high income status at around 2060. To accelerate that by 10 years and achieve it in 2050, Cambodia would need to grow at around 7 per cent per year—5 per cent per year versus 7 per cent per year. In terms of achieving that, I have some good news, some bad news and some great news.

The good news is that Cambodia has achieved this in the past, very recently, and very consistently. If you look at the decade before COVID, Cambodia was growing rapidly in excess of 7 per cent per year. That's the good news. The bad news is that it's going to be harder to replicate that performance now than it was 10 years ago. And that's just the simple fact that the richer a country is, typically, the harder it becomes to grow.

"Finally, the great news. The great news is that what's going to help Cambodia achieve 7 per cent growth over the coming decades is investing in its competitiveness as an economy. And those kinds of programmes and investments are already ongoing – investments to lower the cost of electricity and logistics, lower the cost of doing business. These are things that are so important for building investors' confidence in Cambodia as a production hub, as an investment destination.

“I think we can focus on electricity, because it's a very clear example. The cost of electricity in Cambodia is about double the cost in some of its regional competitors. And, of course, that has serious implications for foreign investors when they're thinking about where to do business. But there are ongoing major investments in strengthening the power grid and accessing alternative energy sources that are going to be very important for lowering that cost of energy and building up Cambodia as a destination.

But in the long term, it's a very bright picture, and the priorities have been the same as they were before these crises. ADB is very proud to stand with the government of Cambodia as a partner on these priorities.